Saudi Aramco, which was wholly state-owned prior to the listing, is the flagship of the economy of the Kingdom. The Company has expanded and diversified through its 80-year history to become the giant in the global oil industry it is today. Aramco is now the largest company exporting crude oil globally, accounting for one in every eight barrels of the global oil supply. The Company has evolved from being a mere crude oil producer, to becoming a leader in hydrocarbon exploration, refining, distribution, and petrochemicals.

Article on pre and post Aramco

MAKING HISTORY TOGETHER

Taking on the largest IPO in history was a major challenge for an emerging Stock Exchange. Onerous preliminary work on a number of aspects of the listing had to be completed. Yet Tadawul faced up to the task and concluded this epoch making event with flying colours.

What drove the listing

The idea of divesting a share of Aramco’s ownership was first mooted about four years ago. Tadawul had then not reached the state of maturity it has today, and the Capital Market Authority (CMA) had given approval to admit Qualified Foreign Investors (QFIs) only shortly before. Recognition by global indices was yet to come. His Royal Highness, Crown Prince Mohammed Bin Salman launched the Vision 2030 plan to diversify Saudi Arabia’s economy and improve the living standards as well as the educational and cultural standards of its people. The listing of Aramco was seen as a means to raise funds for the enormous capital investments required. There were many arduous decisions to be made such as where to list the Company and what percentage of the ownership should be divested in the listing. There were also transparency requirements to be met if Aramco was to go public and the amount the shares were to be priced at in the IPO was also a contentious issue.

Behind the scenes

A historic listing of this magnitude required a great deal of arduous preliminary steps to be taken. While financial requirements for the investments needed to fulfil the Vision 2030 plans loomed large, divesting even a small share of such a prized national asset was not easy.

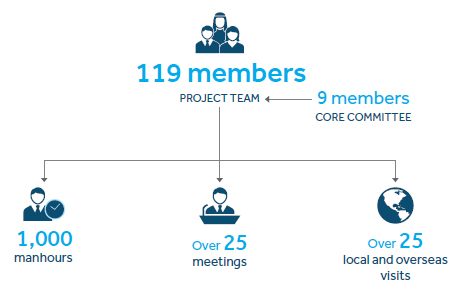

The planning and preliminary work required a huge time and human resources commitment over a period of two years. The project team consisted of 119 members with a core committee consisting of nine members. A total of around 1,000 manhours were spent; over 25 meetings were conducted. It was also necessary for team members to travel, overseas and within the Kingdom, over 25 times in connection with the project.

For an emerging stock exchange, to undertake hosting such a massive IPO was indeed a giant leap. There had to be certain disclosures made before the listing could be launched. The books of accounts of Aramco had to be opened to international listing agencies and profit figures had to be publicly divulged.

In order to minimize time-to-market during the initial book building process, an overlapping retail and institutional subscription process was introduced. Both the retail and the institutional sharebooks were validated daily. The testing process verified not only the resilience of the system but also the readiness of the members and data vendors. Three stress tests with market participants were conducted to test the capabilities of market participants’ systems. Hours of the opening auction were extended so that the end-of-auction would take place later than that of the rest of the market. Rigorous risk mitigation activities were also undertaken to reduce the risks of any potential system failures.

The Securities Depository Center Company (Edaa), too had to revamp its procedures for the IPO. New processes had to be developed, including daily account opening for subscribers, and they needed to be tested and validated. Workshops were conducted with brokers and receiving banks to familiarize them with the process. The end result was an effective and efficient subscription process for all parties – issuer, investors, brokers, and receiving banks. Finally, the IPO was completed with nearly two million subscribers. The issue was oversubscribed by 465%. More than 1,800 transfers were executed from the Lead Manager’s distribution account to the institutional investors.

The unprecedented magnitude of the listing created a need for major systems development and hardware upgrading to handle massive volumes at the required speed and reliability.

The volume of the listing and the resulting load on systems, necessitated major technological developments. Many functional and non-functional trading systems had to be developed, delivered, tested, and implemented to be in tandem with the Aramco listing plan and milestones.

The IPO Issuer Upload Application was upgraded to meet the increased requirements. However, to ensure that the shares allocated to institutional investors are deposited in the correct portfolios, these deposits were made by way of Free of Payment (FOP) transfers and not through the IPO upload application.

Enhancements and optimization parameters were implemented in all applications to increase processing speed and throughput. Multiple enhancements were made to the network performance by increasing members’ backhaul links and internet bandwidth.

The infrastructure capacity of Tadawul’s website and other related applications were enhanced to optimize the server performance and handle the increased loads during the Aramco listing. New pages were introduced in the website and menus were modified accordingly to highlight Aramco.

Eight physical servers were also provisioned and added to the existing server infrastructure. The cloud capacity was also upgraded to cope with the requirements of the listing. The Index Capping feature was introduced to regulate the index after the listing.

Comparison with precedents

The listing turned out to be the largest in history in terms of the total market capitalization. On the second day of trading the market valuation of Aramco touched USD 2 Tn.

The Saudi Aramco listing, as anticipated, proved to be the largest IPO in history in terms of market capitalization. To place this in context, let us take a look back at a few other history-making IPOs.

Market capitalization (USD Bn)

It is clear that Aramco is by far the largest in terms of market capitalization. Although it is leading in the free float as well, it is not so far ahead of the others as only a small fraction of the ownership has been divested.

The event

The listing was approved on 3 November 2019, and after a book building period of about five weeks it was opened for trading on 11 December. The listing initially raised USD 25.6 Bn making it the largest IPO ever; the shares were priced at 32 Riyals valuing the Company at USD 1.7 Tn. Aramco pulled ahead of Microsoft and Apple to become the world’s most valuable listed company. After increasing by 10% on the first day of trading, the Aramco share price rose by another 10% on the second day, resulting in a market capitalization of USD 2 Tn. The time commitment on all the preparatory work on infrastructure yielded results when the initial allocation of shares was uploaded within 18 hours.

The listing is expected to uplift the liquidity in the market and draw new foreign investment portfolios focussed on hedging.

In January 2020, Aramco exercised its "greenshoe" option to sell additional shares for USD 3.8 Bn, bringing the total amount raised to USD 29.4 Bn.

Post-listing impact

At the end of December the Tadawul All Share Index (TASI) increased to 8,389 from 7,859 at the end of the previous month, an increase of 6.7%.

The market capitalization of Aramco as at 31 December 2019 was USD 1,880 Bn which was 78.13% of the total market capitalization. The total market capitalization at the end of November was USD 492 Bn, so there was an increase of nearly 400% in the market capitalization as a result of the Aramco listing. The launch vaulted Tadawul into the position of the world’s tenth largest stock exchange. The total value of shares traded in December 2019 was USD 30.13 Bn of which Aramco accounted for USD 10.32 Bn (34.2%.). The value traded in November 2019 was USD 15.44 Bn, and the figures show that the Aramco listing has accounted for the bulk of the increase. The corresponding figures for the TASI were 8,389 and 7,859. Aramco’s index weight based on free float market capitalization was around 10% at the end of 2019.

The Aramco listing is expected to increase the liquidity in the market and facilitate entry of new foreign investment portfolios. This is anticipated to spur the development of derivative products.

Initially only a small fraction of the Aramco ownership (1.5%), was divested and released for trading, with the “greenshoe” option increasing it to 1.725%. However, with the possibility of a larger share being made available to the market in the future, Aramco could play an even greater role in the expansion of the Exchange and contribute further towards attaining the goals of Vision 2030.

We have seen the dawn of a new era and greater vistas lie ahead.