Capital market offering

Extensive preparatory work was done for the launching of derivatives. A complete new infrastructure, including a new trading engine and a new clearing system has been set up. Muqassa has been enabled to clear and settle derivative contracts. Tests have been successfully and proactively conducted on all new systems to ensure they are functioning according to requirements. Members and banks have been familiarised with the new systems and procedures through workshops and training programmes.

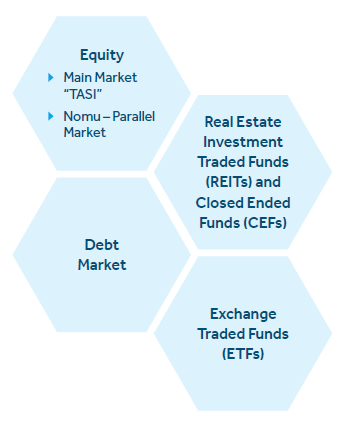

Closed Ended Funds (CEFs) is another new product that is due to be introduced. These are instruments which will be traded on the Exchange similar to equities. They will give an added investment opportunity, increase diversification and reduce risk.

Achievements of the Market Information Division

Major improvements were also made in market information and indices during the year. Enhancements were made to the e-reference Data Portal making a wide range of data sets and reports available to its subscribers. Index rules and methodology were also updated after sharing with all market participants and the public. Market Information Division conducts continuous dialogues with portfolio managers, data vendors, and index providers to obtain their feedback on existing products and services and potential for new innovations and enhancements. New equity and fixed income indices are anticipated to be introduced in 2020 including Sharia Index, Corporate Governance Index, and Environmental, Social and Governance Index.

Achievement of the Listing Department

Reaching out to the market

As part of the Division’s efforts to promote the importance of a good investor relations (IR) function in an organization, it has been carrying out a campaign to raise awareness on the subject amongst organizations in the Kingdom. The campaign which has been running for three years now, had the following achievements during the year under review.

- 6 IR workshops conducted for the market, one of which was in partnership with the Middle East Investor Relations Association (MEIRA). The 30 largest companies were invited for this workshop, with a >50% attendance rate.

- Began collaborations with universities on IR lectures for students.

- 5 university visits receiving a 100% positive feedback on programmes conducted.

- 2 IR post listing support presentations.

- Began CIRO Exam preparation to be provided in the KSA. Further discussion is in progress with the CMA to assist fund the exam’s costs.

- Increased IR awareness by making multiple media posts regarding the value of the IR function.

Another focus area was making listed companies more conscious of the importance of investor relations. Our efforts in this direction have included launching of the Investor Relations toolkit, workshops and training sessions. The fact that our endeavours have been fruitful is shown by the fact that a Saudi company won the Grand Prix Award for 2019 of the Middle East Investor Relations Association (MEIRA).

In pursuance of the initiative “Incentivize and encourage private companies to offer and list their shares on the stock market” of the FSDP, a number of incentives have been provided to encourage private companies to offer and list their shares. These incentives, numbering 10 in all, have been initiated by the Capital Market Authority in partnership with the relevant Government entities. Some of the incentives are financial such as increasing the loan limits granted by the Saudi Industrial Development Fund (SIDF) to listed companies. Others are non-financial like providing a dedicated relationship manager to handle all transactions with a listed company and providing a fast track service to handle requests and surmount difficulties.

Incentives for listing on the Saudi Stock Exchange (Tadawul)

Saudi Customs

- Giving listed companies priority in applying to the Authorized Economic Operator Program.

Saudi Industrial Development Fund

- Increased loan limits granted to listed companies.

Saudi Food & Drug Authority

- Fast track services at the Authority’s Business Support Center and advisory services including training courses on the Authority’s electronic systems.

Ministry of Health

- Priority on training programmes, reporting and statistical data and advertisement at Ministry events.

Ministry of Investment

- Facilitated approval process for listed companies to register foreign partners (joint ventures).

Ministry of Finance

- Preference in business and Government procurement (under competition and Government procurement rule) for listed companies in the Stock Exchange.

Agricultural Development Fund

- Increased funding percentage, and increased credit services limits for each customer.

General Authority of Zakat and Tax (GAZT)

- Providing a relationship manager for listed companies to help settle all transactions with the Authority and follow up on all tasks related to Zakat or income taxes.

- Providing a fast-track service to deal with the requests of companies listed on the Stock Exchange.

Projects Priority Office (PPO)

- A fast track to overcome Governmental challenges that the listed companies might face.

Ministry of Human Resources and Social Development

- Inclusion of all listed companies on SAFWAH Program.

Achievements of marketing and communications

The following marketing and communication activities were conducted during the year which significantly contributed to building awareness of Tadawul’s operations and development not only locally, but regionally and globally as well.

- Conducted 16 events including listing events

- Implemented 92 communication activities:

30 press releases;

42 media interviews;

20 announcements

- Produced over 1,800 pages of marketing materials (30% growth over 2018)

- Over 2,800 social media posts were made (30% growth over 2018)

- Reached 338,000 followers (35% growth over 2018)

The Exchange is constantly seeking to enhance its customer experience through its website, mobile, contact centre, and surveys. An enhanced Search Engine Optimization (SEO) process was implemented for the website. The Contact Centre handles enquiries from Tadawul and its subsidiaries through e-mail, chat, calls, and social media.

The following are some highlights of the customer experience:

- 39,437 customer engagements (22.35% higher than 2018) – a focus on enhanced customer experience

- 98% customer satisfaction rate across all channels in terms of Service Level Agreements (SLAs)

- 1 hour 18 minutes turnaround time achieved by the Contact Centre, out of a target of 2 hours for social media inquiries, in line with international standards and best practices

- One of only two exchanges included in MSCI EM Index that have Contact Centre live chat and social media

- Over 40 surveys conducted with feedback collected from 11,000+ individuals

- Customer Relationship Management System:

- Has 40 trained users

- Covers 14 sales processes

- Recorded 400 new leads

- Achieved 3,000 new contacts

- 10,000 new Contact Centre cases

Opportunities and developments

Opportunities and developments

- A preliminary step was taken towards expanding regionally when Edaa signed MOUs with Abu Dhabi Stock Exchange and Bahrain Clear to permit foreign firms to list on Tadawul. This is only a first step and further developments can be expected.

- The Ifsah Professional Certification was launched in collaboration with the Financial Academy relating to disclosure information for listed companies and investment funds. It aims to achieve compliance in disclosure with listing rules, related regulations, corporate advertising and investment fund announcements. The certificate will be mandatory for all liaison officers of public securities and funds from 1 January 2021.

Opportunities and developments

Opportunities and developments